work opportunity tax credit questionnaire social security number reddit

Work Opportunity Tax Credit. The amount of the WOTC is calculated as percentage of qualified wages paid to an eligible worker during the eligible employees first year of employment.

Fraudsters Set Up Site Selling Temporary Social Security Numbers

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers.

. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the. 5 If the eligible. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment.

There are two sets of frequently asked questions for WOTC customers. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit. WOTC is a federal.

The answers are not supposed to give preference to applicants. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that. After the required certification is received tax-exempt employers claim the credit against the employers share of Social Security tax by separately filing Form 5884-C Work.

As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

State Sen Kevin De Leon Democrat Kmph

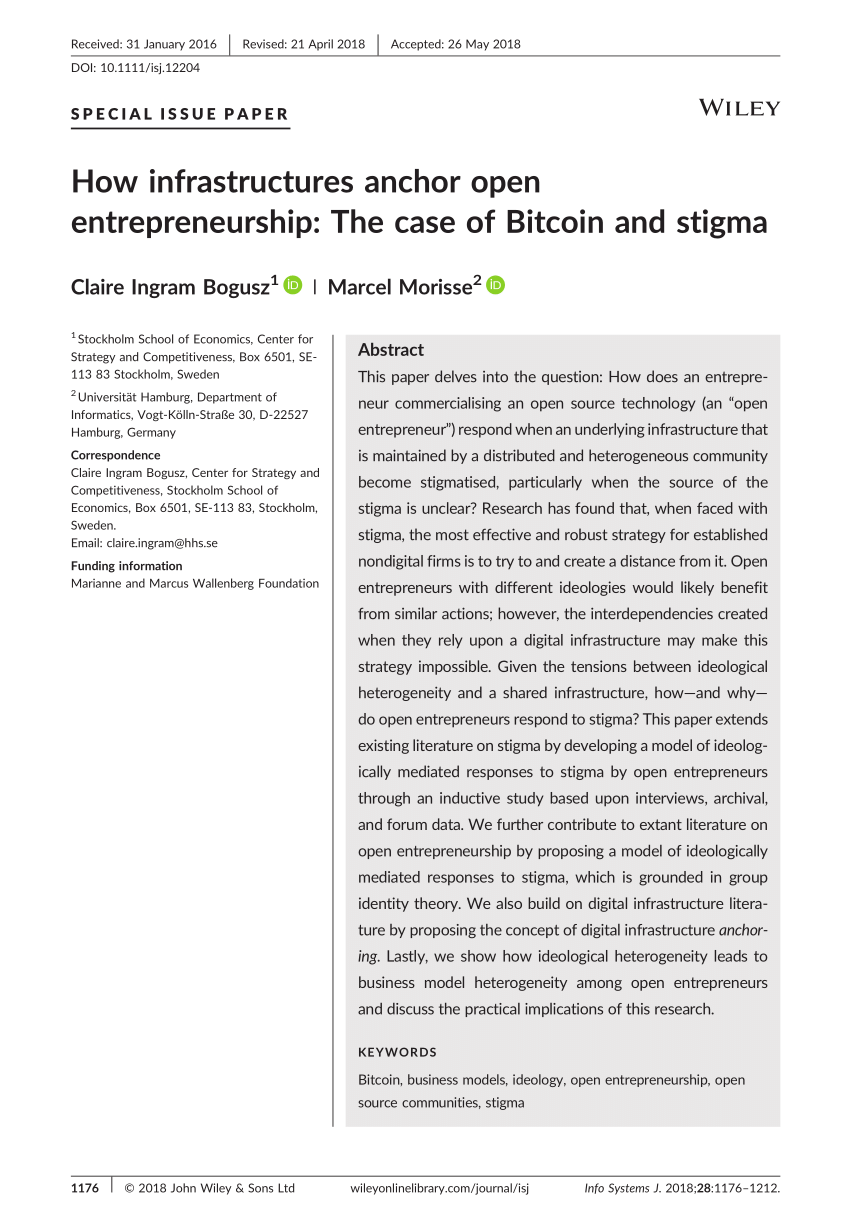

Pdf How Infrastructures Anchor Open Entrepreneurship The Case Of Bitcoin And Stigma

20 Surprising Finds That Make The World A Sillier Place

Ndrn Commits To A Fair And Accurate Census In Census Counts Coalitions Ndrn

Top Paid Medical Surveys In 2022 Physician On Fire

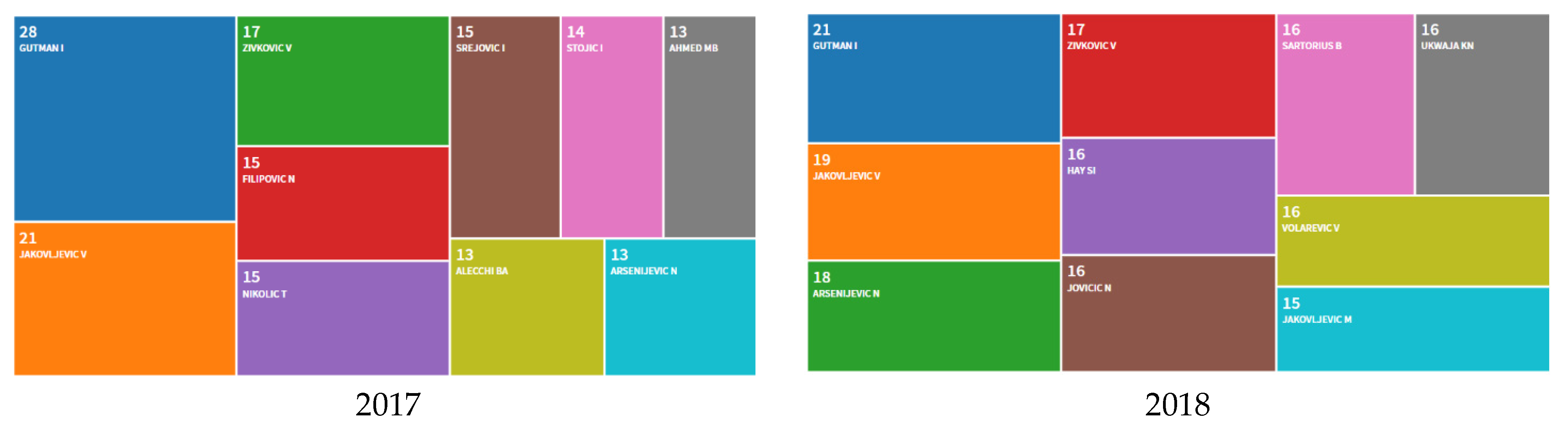

Sustainability Free Full Text Improvement Of Quality Of Higher Education Institutions As A Basis For Improvement Of Quality Of Life Html

Integrating Sustainable Islamic Social Finance An Analytical Network Process Using The Benefit Opportunity Cost Risk Anp Bocr Framework The Case Of Indonesia Plos One

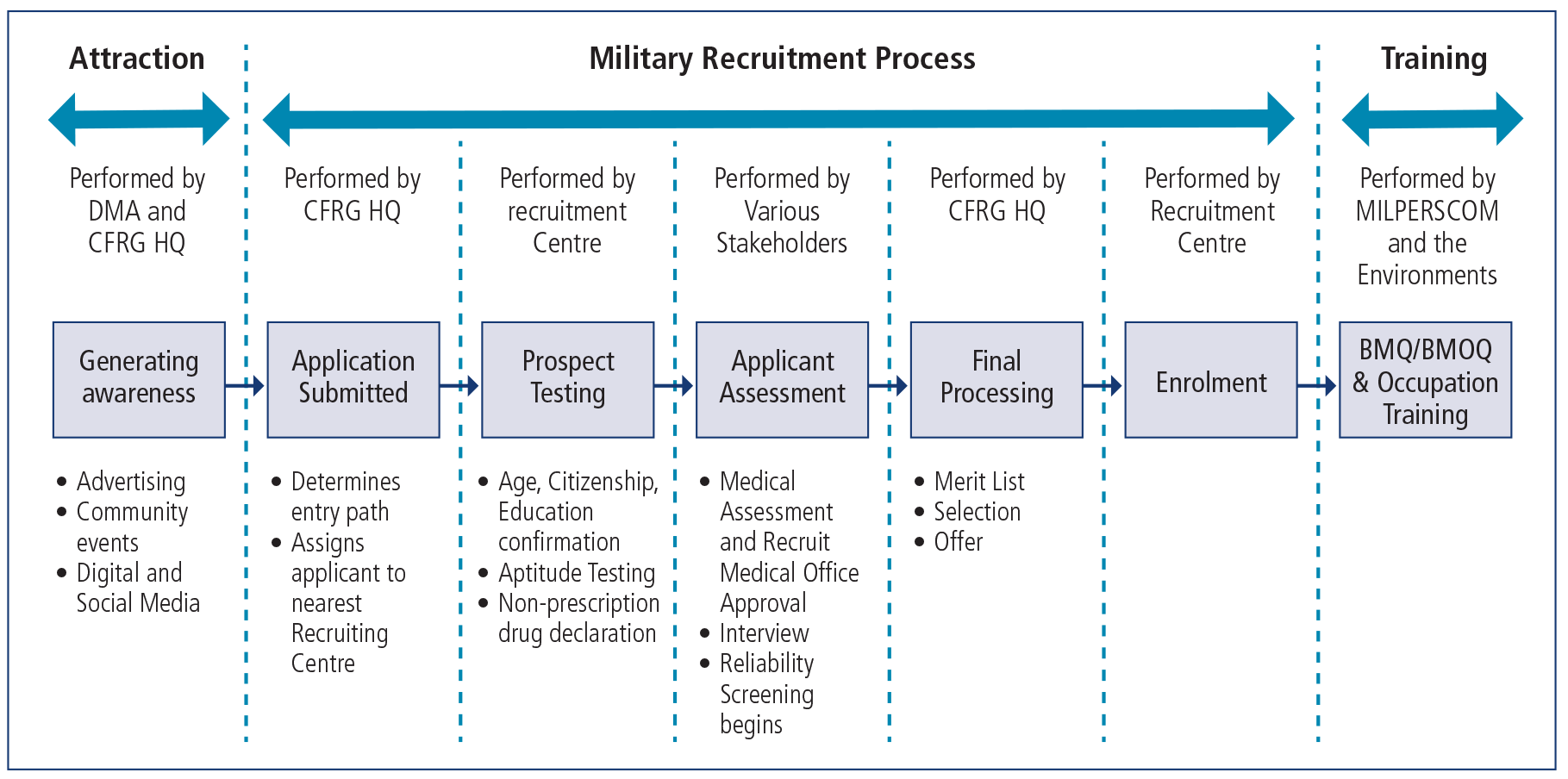

The Hiring Process At Fedex From Application To Interview To Orientation Toughnickel

Is It True That University Tuition Is So Expensive In Japan That Many Are Unable To Go To School Quora

Gamestop Stock Price Spike Understanding Reddit S Wallstreetbets Short Squeeze

Filling Out The Work Opportunity Tax Credit R Jobs

Resisting Disinfodemic Media And Information Literacy For Everyone By Everyone Selected Papers

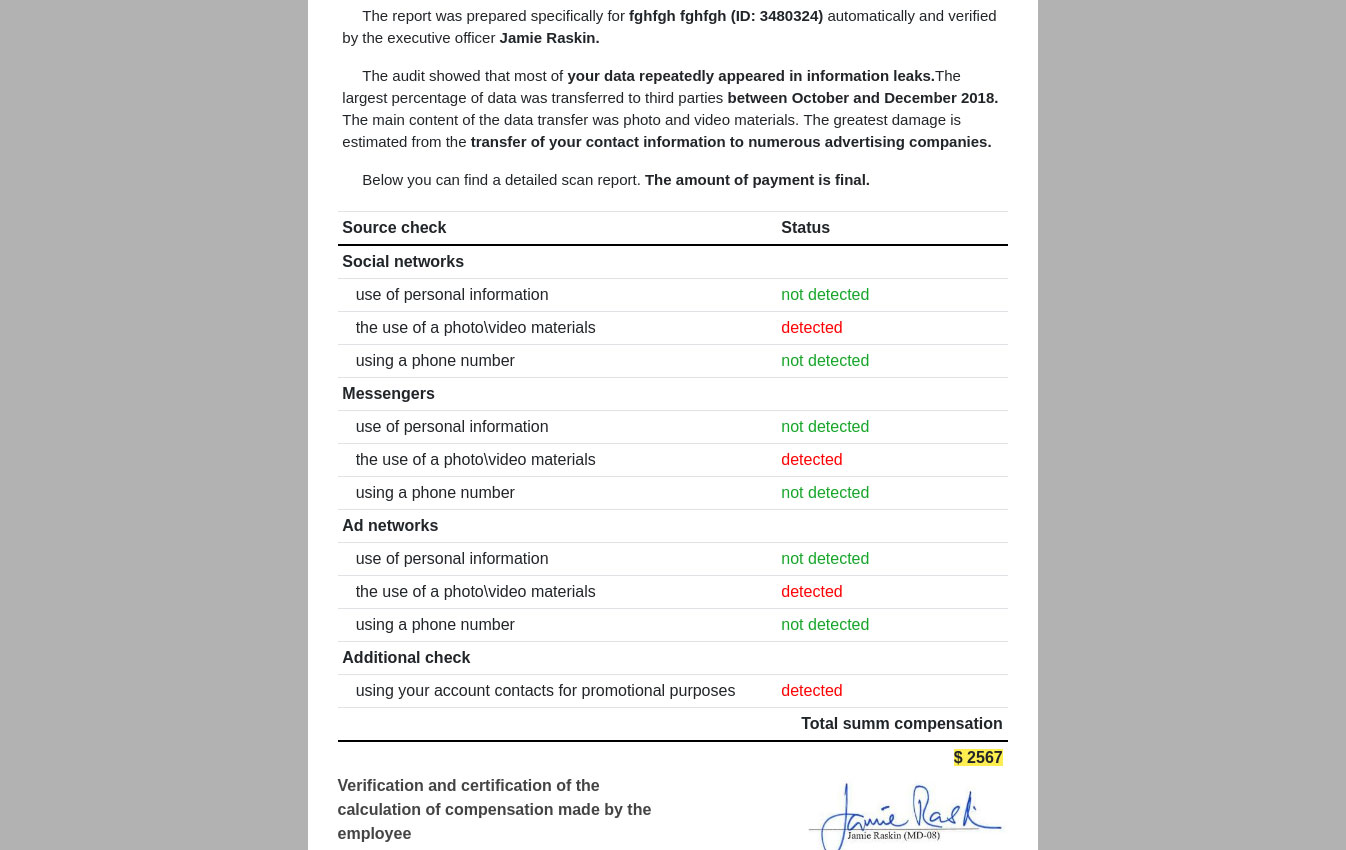

This Company Wants Me To Fill Out A Tax Credit Questionnaire And Give Them My Social Security Number As Part Of My Application Is This Even Allowed R Workreform

Stay Home Stay Safe Save Lives An Analysis Of The Impact Of Covid 19 On The Ability Of Victims Of Gender Based Violence To Access Justice Ana Speed Callum Thomson Kayliegh Richardson 2020

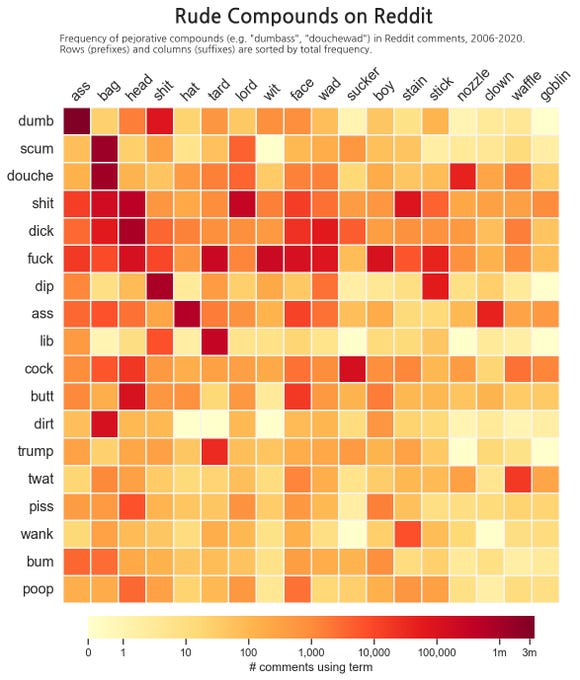

Pdf Reddit Affordances As An Enabler For Shifting Loyalties

Onfolio Holdings Inc Ipo Investment Prospectus S 1

2022 Independent Review Of The Remote Sensing Space Systems Act Rsssa

Reddit L2 Vocab No Entities Pos 100 Dat At Master Ellarabi Reddit L2 Github