portability estate tax return

The IRS thankfully has made electing. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

If you dont file the 706 at.

. This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion. A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an. Trust Professionals Need to Know The University of Texas School of Law 61st Annual Tax Conference Estate Planning Workshop 2013.

To properly make the portability election the surviving spouse must timely file a federal estate tax return known as the United States Estate and Generation-Skipping. Portability occurs when a surviving spouse files an estate tax return for the purpose of calculating and capturing any Estate Tax credit left unused in the estate of the first. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the.

Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. Where the gross estate does not exceed the basic exclusion amount and filing a. Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to.

Portability is the right of an executor to transfer or port the unused estate tax. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her. What Does Portability of the Estate Tax Exemption Mean.

Amarillo Estate Planning Council 23rd Annual. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

The non-exempted amount of 545 million would be portable and would be passed to his wife. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates.

The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an. A Bit of Background. In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Another concept needs to be understood as well portability.

The filing of a Federal estate tax return will nonetheless be required in order to make a portability election.

Form 706 Extension For Portability Under Rev Proc 2017 34

Don T Forget About Making A Portability Election Capell Howard P C

Preparing Form 706 The Federal Estate Tax Return Youtube

Exploring The Estate Tax Part 2 Journal Of Accountancy

Estate Tax Introduction Video Taxes Khan Academy

Tips For Filing Taxes When Married Rings Married Married Couple

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Estate Planning Estate Planning Attorney Law Firm Marketing

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

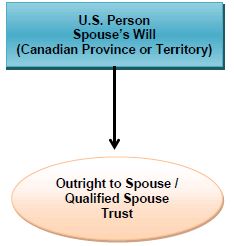

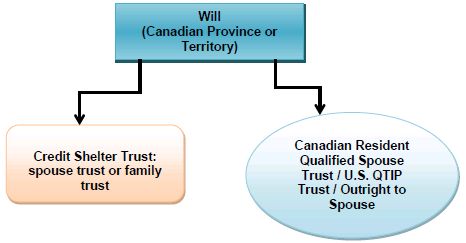

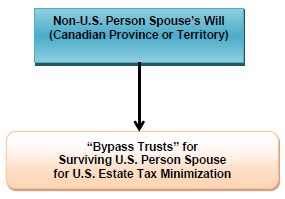

Will And Estate Planning Considerations For Canadians With U S Connections Tax Canada

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Estate Planning Discussion What Is Portability And How Can It Affect You

Will And Estate Planning Considerations For Canadians With U S Connections Tax Canada

Will And Estate Planning Considerations For Canadians With U S Connections Tax Canada

The New Estate Tax Exemption And Portability Panacea Or Poison

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust